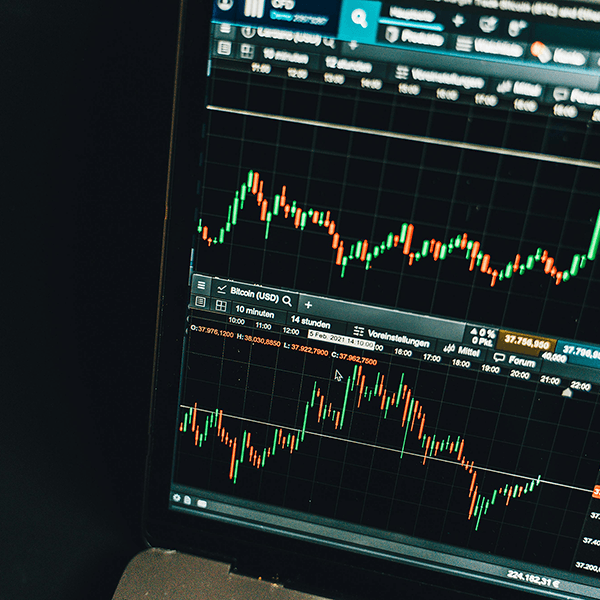

Mortgage rates dipped, then jumped after the Fed’s cut. A $15B corporate bond sale and stronger economic reports added pressure. Here’s the simple, kid-level way to understand what’s happening and what it means for buyers.

Are you self-employed or have inconsistent income? Bank statement loans can make homebuying easier, helping you turn your dreams into reality without the usual roadblocks.

The Federal Reserve cut rates again, but mortgage rates actually rose. Learn why this happens, what Powell said, and what it means for homebuyers.

Buying your first home can feel overwhelming. Discover proven strategies to simplify the process and make confident decisions through each step of your journey.

The average 30-year fixed mortgage rate is hovering near 3-year lows as bond markets hold steady amid limited economic data. Learn why rates remain low and what could move them next.

Discover how VA home loans can help you overcome financial barriers to homeownership. Affordable options make your dream home more achievable than ever.

A new Realtor.com survey reveals that 1 in 5 Gen Z adults say housing affordability is their top life concern. Learn how young buyers are adapting, saving, and staying determined to achieve homeownership.

Struggling with high home prices? FHA loans offer lower down payments and flexible credit requirements, making your dream of homeownership more attainable.

On October 9, 2025, the average 30-year fixed mortgage rate edged slightly higher to 6.38% after a weaker 30-year Treasury auction and mild MBS underperformance. Rates remain stable within a narrow range as the government shutdown continues.